Blog

Employee Benefits Law

Contribution Rules for 401(k) Plans to Change

Starting in 2025, the SECURE 2.0 Act changes 401(k) catch-up contributions. Some changes are optional, but others will be mandatory.

Read More Retirement Plan Limits Increase in 2024

The Internal Revenue Service(IRS) and the Social Security Administration have increased the maximum benefit/contribution limits for 2024.

Read More SECURE 2.0 and the Student Debt Solution for Retirement Plans

President Biden signed into law SECURE 2.0, an Act which implicates a variety of different legal fields, none more significantly than ERISA law. Under the Act, the law now allows talented employees with student loan debt to be compensated for their work through employer matching contributions to a retirement plan.

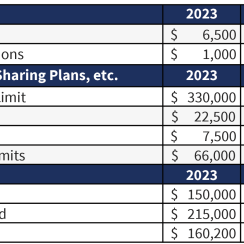

Read More Benefit Contribution Limits Increase in 2023

The Internal Revenue Service(IRS) and the Social Security Administration have increased the maximum benefit/contribution limits for 2023.

Read More Rehiring Retirees and the Impact to Retirement Plans

Retired and Rehired: The IRS had previously issued FAQs to explain the retirement plan rules of the CARES Act. The original guidance answered questions about expanded distribution options and favorable tax treatment for retirement distributions needed because of the impact of coronavirus.

Read More Rudawsky Joins Employee Benefits Team at Barrett McNagny

Larry W. Rudawsky is joining Barrett McNagny as Senior Counsel. He brings over thirty years of experience in the area of employee benefits and has extensive knowledge in the areas of reviewing, developing and implementing defined benefit plans, defined contribution plans, non-qualified deferred compensation plans, employer-sponsored IRA plans and managed IRAs.

Read More IRS Guidance for COVID-19 Testing and High Deductible Health Plans

On March 11, 2020, the IRS released Notice 2020-15, which addresses testing and treatment of the 2019 Novel Coronavirus (COVID-19) under a high deductible health plan (HDHP).

Read More Offering Employees Pre-Tax Benefits? You Need a Cafeteria Plan

With few exceptions, the premium costs paid by employees for group health benefits are paid with pre-tax dollars. In other words, the employee’s portion of healthcare premiums is taken out of the employee’s pay before the employer withholds taxes.

Read More Increases in Health Savings Account Contributions for 2020

The IRS recently announced increases in the health savings account (HSA) contribution limits for the next calendar year.

Read More 401(k) / 403(b) Plans - Selected Developments

This is to update you on certain recent developments pertaining to 401(k) and 403(b) plans, which may affect your plan operations and plan document.

Read More Employers Getting Pushed for 1095s Despite Deadline Extension

On December 28, 2015, the IRS pushed back the date employers must distribute the Form 1095, which was originally due when the Form W-2 was due. Employers now have until March 31, 2016, to send 1095 forms to employees notifying them of their health care coverage for 2015.

Read More Affordable Care Act "Cadillac Tax" Delayed

The Affordable Care Act "Cadillac Tax" delayed for two years.

Read More Browse Categories

- Alternative Dispute Resolution

- Appellate Law

- Bankruptcy and Creditors' Rights Law

- Business and Corporate Law

- Cybersecurity

- Economic Development Financing

- Employee Benefits Law

- Estate Planning & Administration

- Family Law

- Health Care Law

- Intellectual Property Law

- Labor and Employment Law

- Litigation

- News

- Real Estate Law

- Securities Law

- Seminars and Workshops