Blog

Economic Development Financing

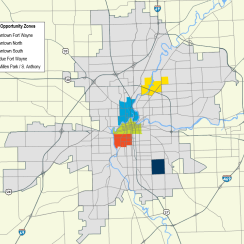

Opportunity Zones

Opportunity Zones were established by the Tax Cuts and Jobs Act of 2017 § 1400Z and are low-income census tracts that are nominated for that designation by each State’s Executive Officer and certified by the U.S. Department of Treasury. They offer preferential tax treatment for new investments in these zones.

Read More A Role For State Tax Credits In The Redevelopment Of Economically Distressed Communities

Economic development, redevelopment, and rehabilitation of abandoned and/or distressed industrial and commercial sites as well as economically challenged and underserved communities is on the rise in Fort Wayne and elsewhere in the Northeast Indiana region.

Read More A Role For Federal Tax Credits In The Redevelopment Of Economically Distressed Communities

Economic development, redevelopment, and rehabilitation of abandoned and/or distressed industrial and commercial sites as well as economically challenged and underserved communities is on the rise in Fort Wayne and elsewhere in Northeast Indiana.

Read More Browse Categories

- Alternative Dispute Resolution

- Appellate Law

- Bankruptcy and Creditors' Rights Law

- Business and Corporate Law

- Cybersecurity

- Economic Development Financing

- Employee Benefits Law

- Estate Planning & Administration

- Family Law

- Health Care Law

- Intellectual Property Law

- Labor and Employment Law

- Litigation

- News

- Real Estate Law

- Securities Law

- Seminars and Workshops